The credit rating that haunts your goals at evening and can awaken you in a chilly sweat is based largely on the historical past of your monetary life. The three major credit bureaus (Experian, TransUnion and Equifax) have their very own model of the FICO score, primarily based on the mathematical model Fair Isaac refined within the late 1970s. Each of the credit score bureaus’ scoring methods is barely completely different, which may result in several scores for a single particular person. In consequence, lenders typically use the middle rating for reference.

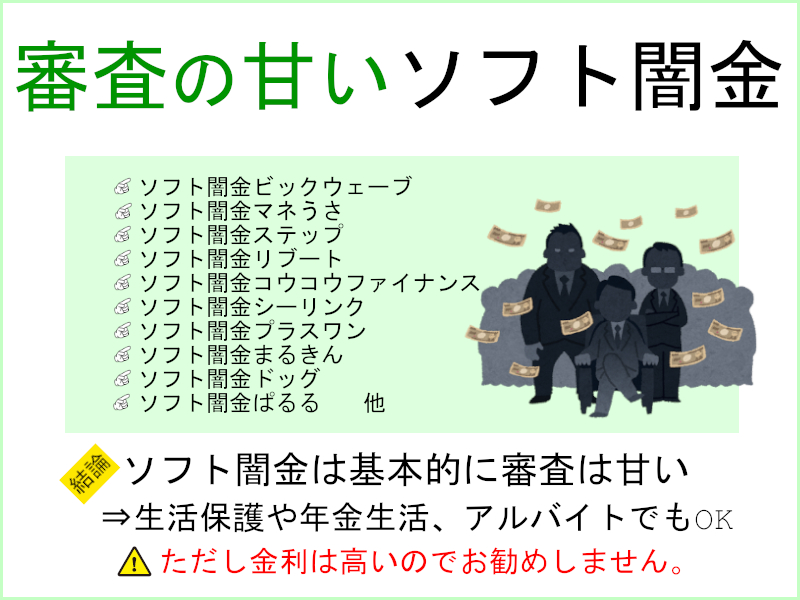

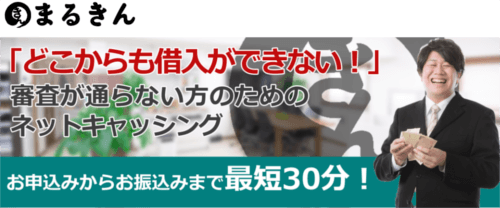

Handlers who don’t actually course of products are exempt from certification as are handlers who solely work with merchandise with lower than 70 percent organic elements. Handlers who choose not to label their merchandise as organic, ソフト闇金まるきんの公式サイトはこちら or who use the phrase organic on the facet panel only, do not require certification.

After a person has been made bankrupt, the first thing they want to do is to rebuild their credit ranking. This can be mandatory if you wish to get a mortgage or a car mortgage. Having a bank card is a vital step in rebuilding your credit rating. Nevertheless, you’ll shortly realize that bankruptcy limits your choices for acquiring a bank card. How long you should have to attend before you can get a brand new bank card after declaring bankruptcy depends upon the issuing company. Be sure you read the situations for any new card you’re provided very fastidiously. It’s possible you’ll find that you’ve very restricted credit facilities, together with high fees and curiosity rates [supply: Whole Bankruptcy]. Read here to learn how to get a credit card after bankruptcy.

.jpg/180px-13-143_JF-17_LBG_SIAE_2015_(18984327841).jpg)